Akhuwat Loan Apply Online Now

Akhuwat Foundation Loan Get an Interest Free Loan Now – Apply Now for Akhuwat Loan in 2024 very easy to apply for a Home loan, Business Loan, Education Loan, Marriage Loan, etc. We are always here to help you in every possible way, and we will support you fully so that you don’t face any problems in taking the loan. Our goal is to deliver your loan amount safely to you, so Akhuwat’s team is always with you. We are here to serve you.

The new loan scheme of Akhuwat Foundation 2024 has been launched; the beneficiaries of this scheme can apply online immediately. In this new scheme, you will get a loan according to Islamic principles. Thousands of applications are being received on a daily basis. If you don’t know how to apply for this new scheme, then immediately contact the Akhuwat WhatsApp support team; they will help you in this matter to the fullest.

Akhuwat Loan Interest Free Scheme

Akhuwat Foundation Loan Scheme is a financial program that provides interest-free loans to the poor and deserving people in Pakistan who wish to expand their businesses and make their lives easier. Akhuwat Loan Scheme provides interest-free loans on very easy terms so that poor and needy people can meet their needs and overcome all obstacles in life and finance.

By taking loans from this scheme people are running their businesses successfully. Apart from business, you can also get loans for your education, health, housing, building a new house, etc. Akhuwat Loan is based on basic principles that include unity and equality first.

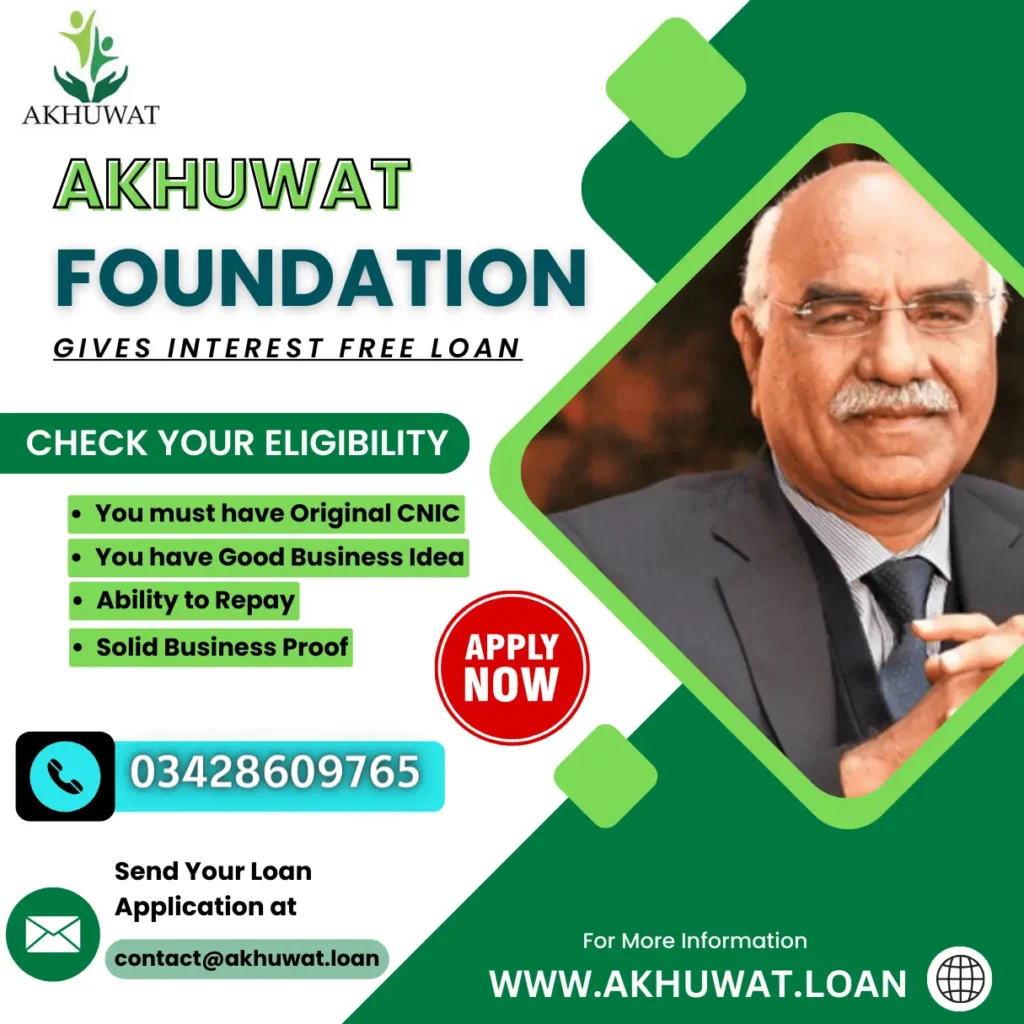

Eligibility Criteria For Akhuwat

- Candidate must have his Pakistani National Identity Card (CNIC) or Passport.

- The applicant will be assessed by the Akhuwat Support Team as being capable of running a business and aged between 18 and 62 years.

- Aspirants must not be involved in any criminal activity or movement for which a character certificate may be required.

- Applicants must be of good social standing, as two sponsors may be required.

- Apart from family, the applicant may also need guarantees from dignitaries of the area.

- If you meet these given eligibility criteria, then you can easily enroll yourself in this Akhuwat program.

Welcome to the Akhuwat Foundation 2024

We are here to help you to provide a Loan in 2024, here you will get all the information about the Akhuwat Loan Scheme. Now apply online to Get a loan of 50,000 to 50,00,000 without an Interest rate.

It is a not-for-profit and behavioral banking-based banking system inspired by Islamic principles that helps needy people start large-scale businesses to meet the expenses of education, shops, and households. Provides interest-free loans for marriage and marriage by promoting compassion and community cohesion to help people avoid unsatisfactory Foundations and utilize all resources to enable people to become self-sufficient in their own businesses.

Since its inception in 2001, the Akhuwat Foundation has been a become of hope for many in Pakistan. This non-profit flips the script on traditional banking. Inspired by the Islamic concept of mawakhat (brotherhood), Akhuwat offers a helping hand to those in need. They provide interest-free loans to kickstart businesses, finance education, or cover pressing expenses. But Akhuwat goes beyond just money.

Prioritizing compassion and community unity, helps people escape the cycle of debt and equips them with the resources and support to become self-sufficient. should get some opportunities so that people can come out of the poverty line. Akhuwat Foundation is appreciated all over the country for its philanthropic work which has been significantly helping to reduce the poverty of Pakistanis all the time.

Check Your Loan Status Online Here

Dear Customers, Now you can Akhuwat Loan Apply Online here. To Check Your Loan status online Please Enter your Valid CNIC Number and Official File Number Provided by the Akhuwat Loan Department. If you have any Problem with Checking Loan online please Call at Akhuwat WhatsApp Helpline Number Thanks!

How you can Check Akhuwat Loan Status Online?

When you take a loan from Akhuwat, it should also have a mechanism to check you so that you know how many installments you have paid and how much is left. This feature was recently introduced by the Akhuwat Foundation It is to be put on the official website where the user can know the status of his loan by entering his ID card number and mobile number/file number and can find out how many installments have been paid and how much is left to be paid.

This system of self-checking loans is easily found on this official website. This modern loan check system is made by the Akhuwat Foundation for better guidance of the customer, so always visit this website and check your loan status. Check it out with your hands we hope you will benefit by choosing this best system

SOME SIMPLE STEPS TO APPLY FOR AKHUWAT LOAN

- First of all, you have to go to the official website of the Akhuwat Foundation which is (www.akhuwat.info).

- Secondly, you have to find the loan check system there, you have to enter your ID card number and mobile number to know the status of your loan.

- Now You have to press the check loan button, then your Akhuwat Foundation loan status will appear in front of you, It will have all the information about how many installments you have paid how much is left how much your total loan and How much time is remaining for your loan.

- your name will also appear there, so you can easily know by using the Akhuwat Foundation loan check system. It is a very user-friendly and useful system introduced by Akhuwat Foundation.

If you don’t understand this method, then you don’t have to worry at all, you have to call the Akhuwat head office contact number immediately and our representative will guide you better.

Akhuwat Foundation Loan Scheme 2024

Akhuwat Foundation has launched a scheme that is very beneficial to everyone. Every poor and rich needy can benefit from this scheme. It is obtained by showing a small proof, it does not require any big proof, usually more than 50 lakhs is required income proof, in which you have to show any of your solid business proof.

We have officially introduced this limit which everyone will be able to use easily because of these activities Akhuwat Foundation is very popular all over Pakistan so apply now from all over Pakistan whether you have a small business or a big business.

Akhuwat Emergency Loan Scheme

People who need an urgent loan can apply for an emergency loan from the Akhuwat Foundation. The purpose of this loan is to help them deal with crisis situations that try to damage their livelihood. These include unexpected expenses and contingencies like losses in their business, hospital expenses, motor vehicle repair expenses, veterinary expenses, and admission fees for children’s schooling (etc.).

This type of financial assistance allows them to continue their livelihoods and prevents them from spiraling into debt and further poverty. This initiative of the Akhuwat Foundation has proved to be very beneficial for the people.

Akhuwat Foundation Loan Update 2024

Pakistan’s only foundation that gives you instant money for any need in just one day with collateral-free and interest-free funds up to Rs.5 lakh with monthly installments of just Rs.3400. Apply now from all over Pakistan to get loan amounts; both men and women can apply.

Akhuwat Foundation 2024 new update is here. 18-year-old men and women can easily apply for a loan that will be a 100% interest-free loan This facility is available in every city of Pakistan. Take an instant loan for any need. Get the contact number of the Akhuwat Foundation Office in your area now.

This is the largest interest-free loan scheme in Pakistan that everyone can benefit from. Everyone can apply for an Akhuwat Foundation Islamic microfinance loan without any guarantee or security. One can easily apply for the loan by contacting our given WhatsApp number for complete details.

Akhuwat Loan Calculator Official

Akhuwat Foundation Loan Calculator provides many valuable benefits for financial planning and decision-making. Use this calculator first when you want to apply for the Akhuwat Foundation Loan Scheme. Create your installment plan on a monthly and yearly basis. Take the benefits of this Akhuwat Loan Calculator App.

Akhuwat Foundation Official Loan Calculator

Sorry

This video does not exist.

| Period | Payment | Interest | Balance |

|---|

1. AKHUWAT HELPLINE

A regular helpline has also been organized in Akhuwat Foundation to provide convenience to the customer. WhatsApp number is also available on this website you will get an official helpline because it is the official website of Akhuwat so if you need any information about loans or loan registration then you can contact the helpline number. +998944758133

2. Interest-Free Loans in Pakistan

Akhuwat Foundation is a very good organization that has successfully introduced interest-free loans for the first time in Pakistan. Qarad Hasana or Charitable Loan has created an excellent and comprehensive model keeping in mind Islamic principles which is completely free of interest.

3. BEST FOUNDATION IN PAKISTAN

In 2023, a complete survey was conducted across Pakistan in which the name of Akhuwat Foundation stood out and won the first position across Pakistan and was crowned as the best foundation, and its founder was awarded the Nobel Prize. And our effort will be to keep his name at the forefront of all the organizations in Pakistan.

Akhuwat Loan Apply Online 2024

For information about Akhwat just call our contact number contact us +998944758133 for any information about Akhwat Foundation you can just call our contact number we will direct you to the Akhuwat head office Provide all the information about us by visiting our website and call quickly we provide you many loans.

In life, we all fall short at times. But don’t worry, Akhuwat is here to ensure your financial stability. With Akhuwat Personal Loan, get customized financing with no collateral requirement and pay in easy monthly installments.

- Financing facility starting from PKR. 50,000 up to PKR. 50,00,000

- Tenure ranging from 1 to 20 Years

- No security/collateral requirement

- Both fixed and variable pricing options are available.

Akhuwat Loan Helpline Number +998 944758133

Total Akhuwat Foundation Approved Applications: 51,478

Akhuwat Loan Requirements & Eligibility Criteria

Applicants must have these mandatory documents to apply for the Akhuwat Foundation Loan. Fulfill these requirements of the Akhuwat Foundation and get your eligibility criteria checked.

1. Applicant Copies of CNIC

- Applicant ( Mandatory)

- Guarantors (Mandatory)

- Family Member (Optional)

2. Latest Utility Bills of Home/Shop

- Applicant (Mandatory)

- For Address Verification & Business Verification

3. Applicant’s Latest Picture

- Applicant (Mandatory)

- For Identification of Biometric

How to Apply for Akhuwat Loan 2024?

If you want to submit an Akhuwat loan scheme application in 2024, you need to visit the Akhuwat Foundation Official website which is (www.akhuwat.Info). There are many updates that you can get in this article. Tell the Akhuwat representative about your business plan when you visit the website or call on Akhuwat Loan Contact number helpline.

Fill out the Akhuwat form and submit your required documents and application form. Remember that the Akhuwat Program is intended for poor people who have less than 40 percent of the basic scale.

It was decided to resurrect the loan program of the Akhuwat Foundation. According to Akhuwat’s latest update, you can acquire a loan ranging from Rs 5 lakh to Rs 50 lakh. You will not be charged interest on a loan of five lakhs. This program allows you to use your economic and financial resources. According to the latest update, everyone can take advantage of this new lending program.

What are the Loan Limits for Akhuwat?

The Akhuwat Foundation allows applicants to request loans with limitations ranging from Rs. 50,000 to Rs. 50,00,000. Under the Akhuwat Foundation initiative, the foundation will provide financial assistance to deserving households. This program provides social benefits to both the destitute and the wealthy. The repayment period is always set as the client requested.

Akhuwat Foundation Loan Contact Number

In order to manage all these, Akhuwat Foundation has established its head office in Lahore, usually its offices are in every city, but its main head office is in Lahore and this is the official website of Akhuwat Foundation. On this you can get the latest information about Akhuwat Foundation, any news, loan scheme, loan registration, or any other information easily, so stay on this website and you can stay informed about all kinds of information here Akhuwat Foundation.

The Akhuwat Loan head office contact number has also been given, which is completely official. You can call it via WhatsApp call or dialing call. If you want to get any information about the Akhuwat Foundation or the loan, always remember to do it yourself. Please dial the contact number of the Foundation Head Office.

AKHUWAT LOAN APPLY 2024

How to Apply for a Loan?

Contact the Akhuwat Head Office Contact Number. when you make a call to Akhuwat Helpline Number then officials will guide you.

Akhuwat Foundation Apna Ghar Scheme

Get the loan for your home, if you want to build your new home then you definitely apply for this Apna Ghar Loan scheme 2024.

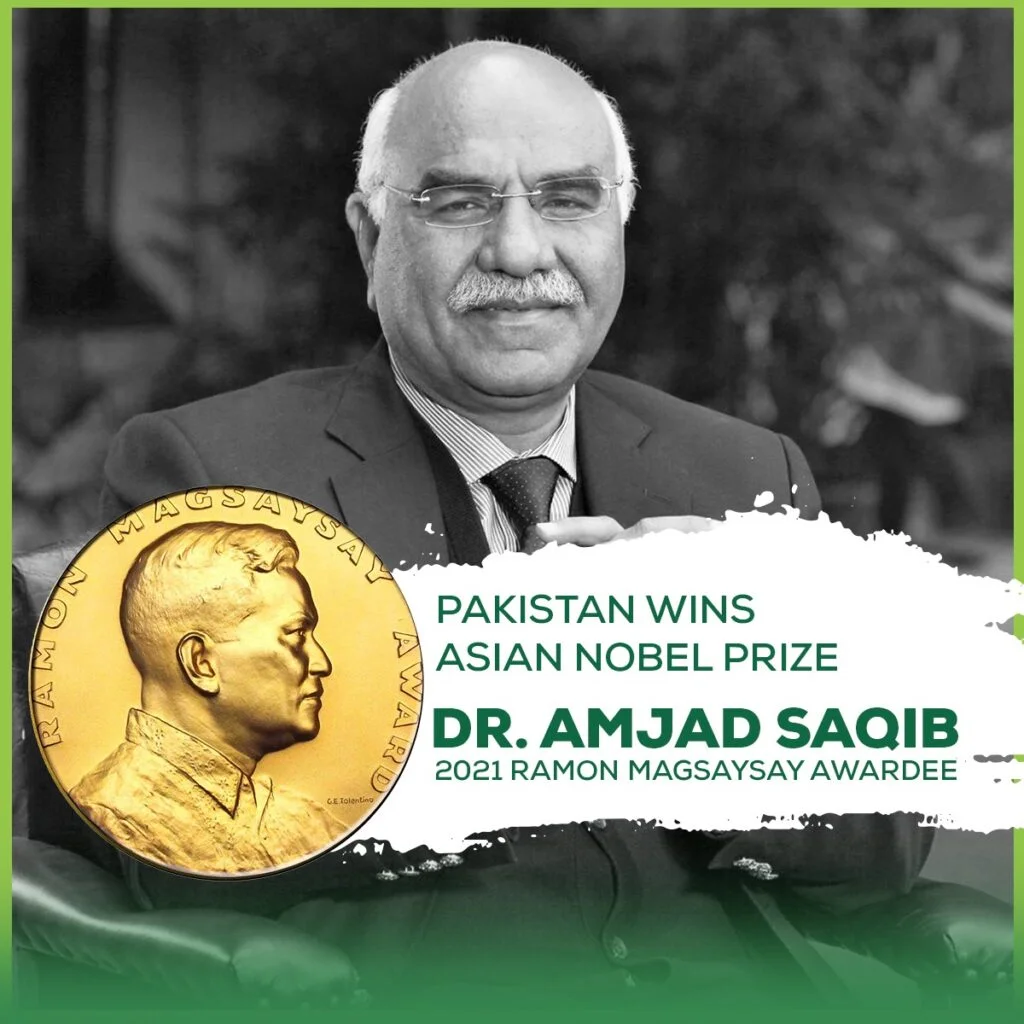

Dr. Amjad Saqib founder of Akhuwat Foundation

Dr. Muhammad Amjad Saqib, founder of the Akhuwat Foundation, has been building self-reliance, not debt, for Pakistanis since 2001.

Akhuwat Loan Scheme 2024

Apply for a loan in 2024 the loan limit for everyone is 50,000 to 50,00,000. you can easily request to approve the loan with some simple steps.

AKHUWAT FOUNDATION HEAD OFFICE MOTO

FAITH. FAVOR. SINCERITY.

Akhuwat Foundation’s approach fosters a sense of shared responsibility and empowers people to break the cycle of poverty.

How can you Apply for Akhuwat Loan

here we have a very simple process to apply and get sood free loan within hours. Akhuwat offers various loan options to suit your needs, such as business loans, education loans, and emergency loans. we likely have application forms and staff who can guide you through the process.

Contact Akhuwat: You can try calling their helpline at +998 944758133 or email contact@akhuwat.Info for information. we likely have application forms and staff who can guide you through the process.

- YOU MUST HAVE CNIC

- SEND YOUR INCOME PROF

- PAKISTANI CITIZEN

- BUSINESS PROFILE

- PREPARE YOUR DOCUMENTATION

- Submit Your Loan Application

- Visit an Akhuwat Branch or Contact Point

TODAY APPLY ONLINE FOR THE AKHUWAT LOAN SCHEME 2024!

Make your dream smile a reality!

AKHUWAT FOUNDATION NEWS

WE HAVE A LARGE NUMBER OF LOAN NEWS. GET YOUR LOAN APPLICATIONS INSTANTLY APPROVE

You don’t need to be a resident of the operational area of the Akhuwat branch, now you can apply online from anywhere in Pakistan, now you can apply for business loans according to your needs, for your house construction, for marriage, or any other. And you can apply according to your needs. Here are some loan limits.

The minimum amount that you can get is 50,000 and the maximum amount that you can get is 50 lakhs. The amount of the installment is monthly, there is no fixed amount for installments. You can do anything according to your convenience. It should be completely interest-free.

Nowadays people are being cheated on Facebook and other social media in the name of Akhuwat Foundation Loan so you should be careful and always get all the information from this official website of Akhuwat if you have any such problem. Incidents in which you can report suspected fraud The WhatsApp number of AKHUWAT Foundation is available for you 24 hours a day.

AKHUWAT LOAN HELPLINE NUMBER

Akhuwat management decided to inform fans of these fictitious calls. Akhuwat Office Number +998944758133 at Akhuwat Foundation Headquarters in Lahore has been launched to educate the populace. People and information seekers in the Akhuwat Qarz program can get help from this official WhatsApp website number.

Here is the official Akhuwat office number where you can join the official staff of this well-known Loan Program for all you Akhuwat Foundation enthusiasts. If you get a false request or piece of information from a person or business, you need to call or WhatsApp. Never give money to these thieves, and be sure the Akhuwat Foundation employees are the real deal.

AKHUWAT FOUNDATION OFFICIAL WEBSITE

Welcome To The Official Website Of Akhuwat Foundation Loan lt Is the Official Website Of Akhuwat Company Pakistan We Have No Other Website Blog So Kindly Always Visit And Check Your Loan Details and Contact Akhuwat Official Website Official Number +998944758133

On the Akhuwat Foundation website, they have given their official email address because people can use it to Contact them for Loan approval and any other questions. If anyone has any questions, they should feel free to contact us via email at helpdesk www.akhuwat.Info and also contact us at WhatsApp Number +998944758133 please contact us in addition to their Email and WhatsApp number can be found on the website for free. If anyone wishes to contact us via WhatsApp, so you should dial the number given our head office is located in Lahore and our Whatsapp Number is +998944758133.

Akhuwat Foundation is A Top-rated And Most Viewed Program In all of Pakistan It Has Deep Roots In Communities Of Pakistan Akhuwat’s Platform is To get loans And A Mission To Eradicate Poverty From The Country.

Akhuwat Loan Scheme Fake Ads on Social Media

People all over Pakistan know the success of the Akhuwat Foundation and its ability to provide interest-free loans. Seeing the success of the Akhuwat Foundation, some criminal elements have come into action and are running advertisements on Facebook and other social media in the name of the Akhuwat Foundation, targeting common people. People are being cheated on a large scale by luring them with interest-free loans for registration fees or other charges.

Akhuwat Foundation is doing its responsibility to inform people, so don’t fall prey to such fraud at all. If you want to take a loan, then directly visit the official website of the Akhuwat Foundation or call the Akhuwat Helpline number. Thanks!